Page not found

Oops! The page you're trying to navigate to can't be found.

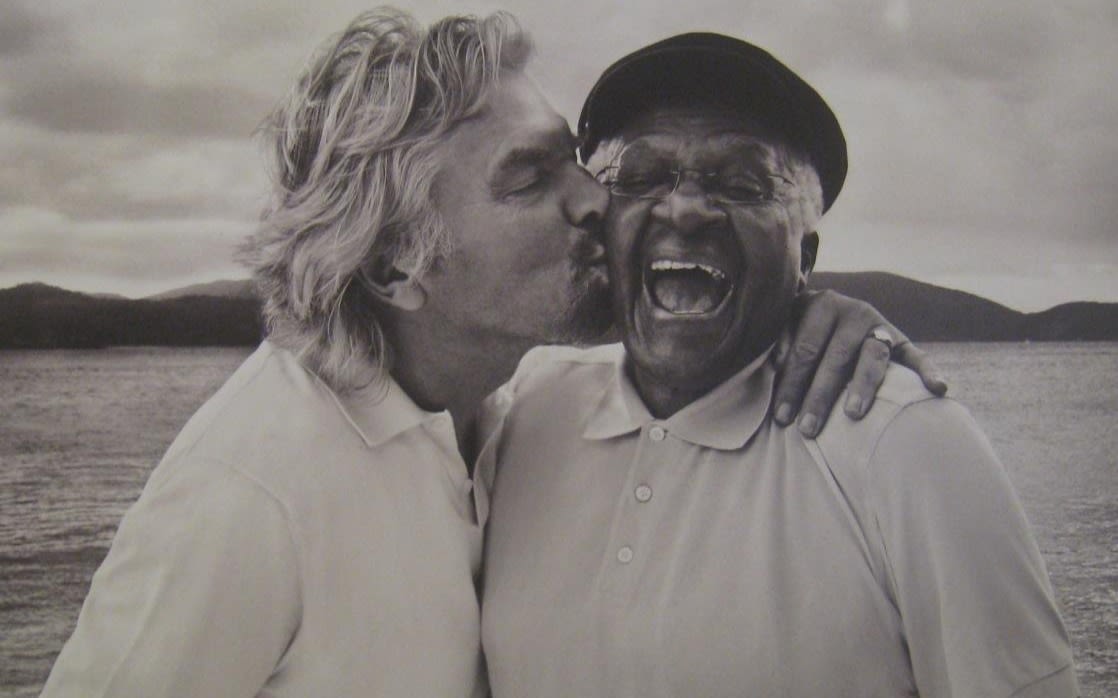

You can either try refreshing the page or returning to our homepage, or you could just take a moment to enjoy one of our favourite photos...

Take me home!

Oops! The page you're trying to navigate to can't be found.

You can either try refreshing the page or returning to our homepage, or you could just take a moment to enjoy one of our favourite photos...

Take me home!